Your family depends on your income to maintain their lifestyle and pursue their dreams. While it’s difficult to imagine a future without you, it’s essential to plan for their security and well-being. Tulane University is here to help you ensure their quality of life remains intact, no matter what. For additional assistance or questions, please contact tubenefits@tulane.edu.

Tulane University partners with The Standard to provide a robust life insurance program, offering both employer-paid and voluntary employee-paid plans.

As a Tulane faculty, staff, or TUMG member, you are automatically enrolled in Basic Life Insurance, which provides coverage equal to 1.5 times your annual salary, up to $50,000, at no cost to you.

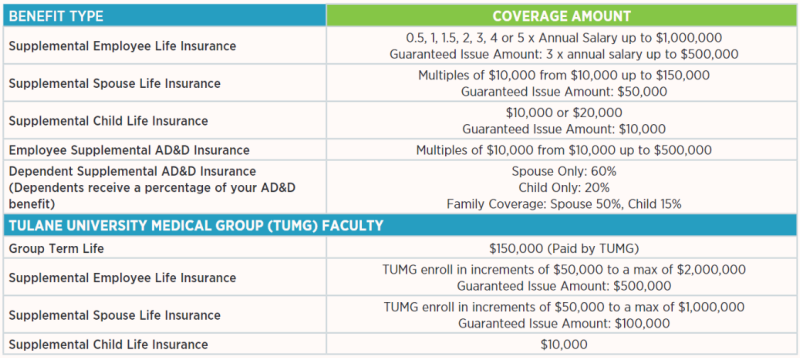

Supplemental Life & AD&D Insurance

For added protection, you can purchase Supplemental Life and Accidental Death and Dismemberment (AD&D) coverage for yourself and your family. This optional coverage offers peace of mind, knowing your loved ones have financial support for unforeseen circumstances.

To purchase Supplemental Life coverage for your spouse or child(ren), you must first enroll in coverage for yourself. You will pay 100% of the cost for this additional coverage. Rates are affordable and vary by age; please refer to the plan summaries for details.

- A Statement of Health application is required if you select coverage above the Guaranteed Issue amount.

- Age Reductions: Coverage amounts may be reduced as you age.

You are not required to purchase Supplemental Life coverage in order to enroll in AD&D. You can choose AD&D coverage independently.

Important Note: If both you and your spouse are employed by Tulane, you cannot be covered under each other’s policy.

In addition to life insurance options, Tulane provides a Death Benefit equal to one month of your salary. For more information, please refer to the detailed plan summary here.

You are eligible for coverage if you meet the following criteria:

- Full-time employees scheduled to work at Tulane for at least 7 months.

- Part-time employees working at least 50% of a full-time schedule and expected to work for no less than 7 months.

If you are electing new coverage or increasing your current coverage after your initial 30 days of employment or eligibility, a Medical History Statement is required. This applies to:

- Supplemental Employee Life coverage over 3X your annual salary.

- Supplemental Spouse Life coverage over $50,000.

- Supplemental Child Life coverage over $10,000.

Exceptions: Medical History Statements are not required for increases in AD&D coverage.

Submission Process: All statements are submitted electronically via The Standard’s website. Click here to complete your statement.

If your application is not approved, your benefits will default to your prior enrollment or the Guaranteed Issue amount, as outlined in the certificate of coverage.

What to Expect After Submitting Your Statement

Once your Medical History Statement is submitted, here’s what you should know:

- Processing Time: Approval or denial may take up to 90 days.

- Coverage Status: While your statement is being reviewed:

- Current coverage and premiums will remain in interim status.

- New coverage and premiums will show as suspended in Employee Self-Service.

- Outcome:

- If approved, your new coverage and premiums will take effect.

- If denied, your current coverage and premiums will remain unchanged.

For additional assistance or questions, please contact benefits@tulane.edu.