The payroll operation exists not just to pay people, but also to support the organization’s financial stability, satisfy payroll compliance requirements, and produce useful information about the workforce. Payroll continually improves and standardizes business practices in coordination with the university’s strategic plan. Additionally, payroll provides quality customer service and support to the university community, state and federal agencies. Please see the bottom of this page for additional information.

Federal Form W-4

Due to the Tax Cuts and Jobs Act of 2017, the Internal Revenue Service (IRS) released a new version of the federal Form W-4 (Employee Withholding Allowance Certificate) in 2020. Employees can review the latest draft form and instructions to familiarize themselves with these changes.

W-2 Information

The quickest method to receive your W-2 is by opting for electronic delivery through our tax form-processing vendor, ADP. Your security and privacy are protected with ADP through their ever-evolving tools, technology, and safeguards to provide confidentiality, integrity, and availability of your information. If you're already registered with ADP, you'll automatically receive an email notification once your W-2 becomes available.

Benefits of signing up for electronic delivery of W-2s:

- Receive your electronic W-2 earlier than a paper form

- Email notification when your electronic W-2 is available

- You can print unlimited copies securely from your home or office

- You can reprint W-2s from previous years

Additional Tax Form Information:

The requirements of the Affordable Care Act (ACA) make the distribution of Forms 1095-B and 1095-C a requirement. Individuals employed by Tulane University will receive a W-2, Form 1095-B, and Form 1095-C. You are not required to file Forms 1095-B or 1095-C when you file your taxes. You should retain these forms for your tax records:

- Form 1095B: United Healthcare will mail this form to your home address.

- FORM 1095-C: ADP, Tulane's partner in Form 1095-C administration, will distribute this form.

You can also find detailed information about the ACA at http://www.hhs.gov/healthcare/.

Tax Form Definitions and Tulane Contact Information

| Tax Form | Tulane Office | Telephone Number |

|---|---|---|

| 1042-S Foreign Person’s U.S. Source Income Subject to Withholding | International Tax Office | (504) 865-5625 |

| 1095-C Employer-Provided Health Insurance Offer and Coverage | Benefits | (504) 865-4748 |

| 1098-T Tuition Statement | Accounts Receivable | (504) 865-5368 |

| 1099 Miscellaneous Income | Accounts Payable | (504) 865-5824 |

| W-2 | Payroll | (504) 865-5346 |

Additional Information

Key Dates:

- 2025/2026 Biweekly Student and Staff Payroll

- 2025/2026 Monthly Payroll

- 2024/2025 Biweekly Student and Staff Payroll

- 2024/2025 Monthly Payroll

Student Employees:

Staff Biweekly:

Staff Monthly:

Payroll strives to pay employees correctly and promptly in accordance with approved transactions and time entries processed by departmental personnel each payroll cycle. We also understand that unexpected situations may arise with an employee or department, which can cause the employee to receive compensation to which he/she is not entitled. If this happens, payroll should be contacted as soon as the error has been discovered so they can assist with resolving the overpayment.

An overpayment is defined as compensation paid to an employee greater than the amount owed for a given pay period. Overpayments are legal debts to the university and, according to state law, must be repaid regardless of the origin, error, or amount. Situations contributing to overpayments include, but are not limited to, delays in processing assignment changes for employees who go on leave without pay status or separate from the university, data entry errors, and changes in the work schedule.

Notifications:

When departments become aware that an employee has been overpaid, they should notify payroll immediately. An email should be sent to payroll, which should include the employee’s name, TUID, applicable dates, and a brief explanation of the cause of the overpayment. The timing of this notification is the key to recovering overpayments. Payroll will then evaluate the situation, calculate the amount overpaid, and respond accordingly.

Overpayment Responsibilities:

Departments are required to maintain an effective system of internal controls to prevent overpayments. All employees and departmental personnel who affect the pay process, including those who track and enter time, approve payroll, and produce and disburse payroll, have a responsibility to assist in producing accurate and timely payrolls.

Departments: Departments are responsible for monitoring payroll records and managing the financial resources for their respective areas. To that end, when an overpayment occurs, departmental contacts are expected to assist Payroll in efforts to recover funds in a timely manner and communicate directly with their employees. Additional payments should not be processed for employees who have been overpaid without first consulting with Payroll.

- Ensure that employees have enough leave accruals available prior to approving requests for absence.

- Become knowledgeable about how to access available accrual balances.

- Review employee time records in a timely manner to ensure that leave time taken is accurate.

- Notify Payroll as soon as possible if an employee will be exhausting leave accruals so that a leave of absence can be processed immediately in the Payroll system.

If an employee terminates unexpectedly, the department should process the termination as soon as the supervisor is notified.

Employees: Employees are responsible for checking the accuracy of their payroll payments each pay period, immediately reporting any discrepancies to their department, and making the necessary repayments in accordance with state law. Maintain adequate amounts of accruals and ensure that there are enough leave accruals available prior to making requests for absence. Submit accurate and timely time records.

Payroll is responsible for reviewing each overpayment situation and determining the best course of action for rectifying the error. They will manage the recovery process, including canceling checks, reversing direct deposits, determining repayment options, calculating net overpayment amounts, depositing reimbursed funds, crediting the departmental account, correcting employee payroll records, and amending employee W-2 forms when applicable. Determine if communication systems and/or processes need improvement; consider a lean review of internal communication processes to minimize the impact on salary overpayments.

Overpayment Actions Required:

Terminations

Departments should process terminations as soon as the supervisor is notified, preferably prior to the date of termination.

If an exempt employee terminates unexpectedly—after the 15th of the month—process the termination in EBS immediately and contact Payroll immediately, as they may be able to pull back the ACH for that individual and adjust the paycheck they will be receiving on the last day of the current month.

If a non-exempt employee terminates unexpectedly, process the termination in EBS immediately and contact Payroll immediately.

Change in Status

Avoid retroactive changes in status if possible. Require that changes be approved the first of the month following the transaction being entered unless they can be entered prior to payroll cutoff in the month that the change in status occurred.

Grants

Overpayments are not allowed on externally sponsored grants and contracts. If an overpayment occurs for an individual who is appointed to an externally sponsored grant or contract, the related costs must be moved, as soon as possible, to an unrestricted funding source. The Grant Accounting Office regularly monitors overpayments to ensure that the costs are moved off as necessary. If, however, you are aware of an overpayment situation related to an externally sponsored grant or contract in your department, please notify Grants and Contracts Accounting so that it can be removed promptly.

Unresolved Overpayments

There is no statute of limitations on indebtedness to the university. If efforts to recover an overpayment are unsuccessful after a reasonable period has elapsed, Payroll will record the uncollected debt as an overpayment and forward it to Accounts Receivable.

To access your tax documents via ADP as they become available each year, please follow these instructions:

- Go to my.adp.com and select “Register Now” to begin.

- Registration Code: TULANEEDU-W2ONLINE (NO “.” between TULANE and EDU)

- Enter your personal identification info

- Select Year of W-2 Needed

- Enter your Employee ID (Tulane SplashCard Number)

- Enter Company Code: V8A

- Enter Your Home Zip Code

- Enter Your Social Security Number

Additional Information:

- Access your W-2.

- Forgot your ADP User ID?

- Change ADP password using Registration Code.

- Change ADP password using Security Questions.

- W-2 Registration Tutorial Video.

For additional questions, please contact payroll@tulane.edu or 504-865-5346.

Understanding Your W-2

- Box A: Your Social Security number appears here.

- Box B: This is your employer's unique tax identification number or EIN.

- Box C: This identifies the name, address, city, state and zip code of your employer. The address may show your company's headquarters rather than its local address.

- Box D: This is a control number that identifies your unique Form W-2 document in your employer's records. This number is assigned by the company's payroll processing software.

- Box E: This identifies your full name. If your name has changed, ask your company to update their records.

- Box F: This identifies your address, city, state and zip code. The address might be a former address if you've recently moved, but this shouldn't be a complication as long as your tax return bears your current, correct address.

Numbered boxes appear on Form W-2 as well. These record your financial information.

- Box 1: Box 1 reports your total taxable wages or salary for federal income tax purposes. The number includes your wages, salary, tips you reported, bonuses and other taxable compensation. For example, taxable fringe benefits such as group term life insurance will be included here. But Box 1 does not include any pre-tax benefits, such as savings contributions to a 401(k) plan, 403(b) plan or health insurance. The amount from Box 1 is reported on Line 7 of your Form 1040 or 1040A, or on Line 1 of Form 1040EZ. If you have several W-2 forms, add up the Box 1 amounts and enter the total.

- Box 2: Box 2 reports the total amount your employer withheld from your paychecks for federal income taxes. This represents the amount of federal taxes you have paid in throughout the year. The amount from Box 2 is reported on Line 62 of Form 1040, on Line 36 of Form 1040A, or on Line 7 of Form 1040EZ. If you have several W-2 forms, add up the Box 2 amounts just as you did with your income.

- Box 3: Box 3 reports the total amount of your wages subject to the Social Security tax. The Social Security tax is assessed on wages up to $118,500 as of 2017. If Box 3 shows an amount over the wage base, ask your employer correct your W-2. Tips reported to your employer are not included in the Box 3 amount. They're reported in Box 7.

- Box 4: Box 4 reports the total amount of Social Security taxes withheld from your paychecks. The Social Security tax is a flat tax rate of 6.2 percent on your wage income up to $118,500 as of 2017. Any wages you earn over $118,500 aren't subject to the Social Security tax, so the figure shown in Box 4 should be no more than $7,347.00, the $118,500 maximum wage base times 6.2 percent. If you had two or more jobs during the year and your total Social Security wages exceed $118,500, you may have paid in more Social Security tax than was required, but you can claim the excess Social Security tax withholding as a refundable credit on your Form 1040.

- Box 5: Box 5 reports the amount of wages subject to the Medicare tax. There is no maximum wage base for Medicare, so the amount showing in Box 5 may be larger than the amount showing in Box 1. Medicare wages include any deferred compensation, 401(k) contributions or other fringe benefits that are excluded from the federal income tax. The amount in Box 5 typically matches your entire compensation from your job.

- Box 6: Box 6 reports the amount of taxes that were withheld from your paycheck for the Medicare tax, which is a flat tax rate of 1.45 percent of your total Medicare wages as of 2017. You might find that the amount in Box 6 is greater than the amount in Box 5 multiplied by 1.45 percent if you earn a significant income. That would be due to the additional Medicare tax which was implemented in 2013. It's an additional 0.9 percent on incomes over certain thresholds as of 2017: $200,000 if you're single or eligible to file as head of household, $125,000 if you're married but filing a separate return, and $250,000 if you're married and filing jointly. If you're subject to the additional Medicare tax, your Medicare tax withholding that shows in Box 6 is reconciled on IRS Form 8959.

- Box 7: Box 7 shows any tip income you reported to your employer. It will be empty if you didn't report any tips. The amounts in Boxes 7 and 3 should add up to the amount that appears in Box 1 if you don't have any pre-tax benefits, or may equal the amount in Box 5 if you do receive pre-tax benefits. The total of Boxes 7 and Box 3 should not exceed the $118,500 Social Security wage base. The amount from Box 7 is already included in the Box 1 amount.

- Box 8: Allocated tips. Box 8 reports any tip income that was allocated to you by your employer. This amount is not included in the wages reported in Boxes 1, 3, 5 or 7. Instead, you must add it to your taxable wages on Form 1040 Line 7, and you must calculate your Social Security and Medicare taxes including this tip income using IRS Form 4137. You might want to review the information in Publication 531 concerning allocated tips or consult with a tax professional if any income shows in Box 8 of your W-2.

- Box 9: Box 9 was once used to report any advance of the Earned Income Credit, but advance earned income credit ended in 2010 so this should be empty. Advance EIC payments were advance payments from an employer to an employee in anticipation of the employee being eligible for the earned income credit.

- Box 10: Box 10 reports any amounts you might have been reimbursed for dependent care expenses through a flexible spending account, or the dollar value of dependent care services provided to you by your employer. Amounts under $5,000 aren't taxable, but any amount over $5,000 should be reported as taxable wages in Boxes 1, 3 and 5. Dependent care benefits are reported on Form 2441.

- Box 11: This box reports any amounts that were distributed to you from your employer's non-qualified deferred compensation plan or non-government Section 457 pension plan. The amount in Box 11 is already included as taxable wages in Box 1.

- Box 12: This box applies to deferred compensation and other compensation. Several types of compensation and benefits can be reported in Box 12 so the IRS has simplified this as much as possible by allowing your employer to enter a single letter or double letter code followed by the dollar amount of your compensation. These are the codes as of 2017:

|

Code A |

Uncollected Social Security or RRTA tax on tips. Include this amount as part of your total tax on Form 1040. |

|

Code B |

Uncollected Medicare tax on tips. Include this amount as part of your total tax on Form 1040. |

|

Code C |

Taxable benefit of group term-life insurance over $50,000. This amount is already included as part of your taxable wages in Boxes 1, 3, and 5. |

|

Code D |

Non-taxable elective salary deferrals to a 401(k) or SIMPLE 401(k) retirement plan. |

|

Code E |

Non-taxable elective salary deferrals to a 403(b) retirement plan. |

|

Code F |

Non-taxable elective salary deferrals to a 408(k)(6) SEP retirement plan. |

|

Code G |

Non-taxable elective salary deferrals and non-elective employer contributions to a 457(b) retirement plan. |

|

Code H |

Non-taxable elective salary deferrals to a 501(c)(18)(D) tax-exempt plan. This amount is included in box 1 wages. See the Instructions for Form 1040 for how to deduct this amount. |

|

Code J |

Non-taxable sick pay. This amount is not included in taxable wages in Boxes 1, 3, or 5. |

|

Code K |

Excise tax (equal to 20%) on excess "golden parachute" payments. Include this amount as part of your total tax on Form 1040. |

|

Code L |

Non-taxable reimbursements for employee business expenses. |

|

Code M |

Uncollected Social Security or RRTA tax on taxable group term life insurance over $50,000 for former employees. Include this amount as part of your total tax on Form 1040. |

|

Code N |

Uncollected Medicare tax on taxable group term life insurance over $50,000 for former employees. Include this amount as part of your total tax on Form 1040. |

|

Code P |

Non-taxable reimbursements for employee moving expenses, if the amounts were paid directly to the employee. This amount may need to be used on Form 3903 (pdf) when calculating how much moving expenses to deduct |

|

Code Q |

Non-taxable combat pay. Some individuals may elect to include combat pay when calculating their Earned Income Credit. See Publication 3 for more details about the combat zone exclusion. |

|

Code R |

Employer contributions to an Archer Medical Savings Account. This amount should be reported on Form 8853 (pdf). |

|

Code S |

Non-taxable salary deferral to a 408(p) SIMPLE retirement plan. |

|

Code T |

Employer paid adoption benefits. This amount is not included in Box 1 wages. Use Form 8839 to calculate the taxable and non-taxable portion of these adoption benefits. |

|

Code V |

Income from the exercise of non-statutory stock options. This amount is already included as taxable income in Boxes 1, 3, and 5. However, you will still need to report separately the sale of any stock options on Schedule D and Form 8949. |

|

Code W |

Employer and employee contributions to a Health Savings Account. Report this amount on Form 8889. |

|

Code Y |

Salary deferrals under 409A non-qualified deferred compensation plan. |

|

Code Z |

Income received under 409A non-qualified deferred compensation plan. This amount is already included in taxable wages in Box 1. This amount is subject to an additional tax of 20% plus interest as part of your total tax on Form 1040. |

|

Code AA |

After-tax contributions to a Roth 401(k) retirement plan. This amount is included as part of your box 1 wages. |

|

Code BB |

After-tax contributions to a Roth 403(b) retirement plan. This amount is included as part of your box 1 wages. |

|

Code DD |

Reports the cost of non-taxable health insurance provided through your employer. |

|

Code EE |

After-tax contributions to a Roth 457(b) retirement plan offered by government employers. This amount is included as part of your box 1 wages. |

- Box 13: Three check boxes appear in Box 13. They'll be marked off if any of these situations apply to you as an employee:

You're a statutory employee. This means that you report the wages from this W-2 — and any other W-2 forms you receive that are marked "statutory employee" — on Form 1040 Schedule C. Your wages are not subject to income tax withholding, so you should see a zero or blank amount in Box 2. They are subject to Social Security and Medicare tax withholdings, however, so Boxes 3 through 6 should be filled out. For a discussion of what constitutes a statutory employee and the rules that apply, see section 1 of Publication 15-A.

You participated in your employer's retirement plan during the tax year. This might be a 401(k) plan, a 403(b) plan, SEP-IRA, SIMPLE-IRA or another type of pension plan. Your ability to deduct contributions to a traditional IRA may be limited based on your income if you participate in a retirement plan, so check with an accountant or other tax professional if this box is checked.

You received third-party sick pay under your employer's third-party insurance policy instead of receiving sick pay directly from your employer as part of your regular paycheck. Sick pay is not included in your Box 1 wages, although sick pay is usually subject to Social Security and Medicare taxes. See Section 6 of Publication 15-A for a discussion of sick pay and third-party sick pay,

- Box 14: Your employer may report additional tax information here. If any amounts are reported in Box 14, they should include a brief description of what they're for. For example, union dues, employer-paid tuition assistance or after-tax contributions to a retirement plan may be reported here. Some employers report certain state and local taxes in Box 14, such as State Disability Insurance (SDI) premiums. State disability insurance premiums may be deductible as part of the deduction for state and local income taxes on Schedule A if you itemized, and union dues may be deductible as a miscellaneous itemized deduction.

- Box 15: Box 15 reports your employer's state and state tax identification number. There may be multiple lines of information here if you worked for the same employer in multiple states.

- Box 16: Box 16 reports the total amount of taxable wages you earned in that state. There may be multiple lines of information here, too, if you worked for the same employer in multiple states.

- Box 17: Box 17 reports the total amount of state income taxes withheld from your paychecks for the wages reported in Box 16. This amount may be deductible as part of the deduction for state and local income taxes on Schedule A if you itemize your deductions.

- Box 18: Box 18 reports the total amount of wages subject to local, city or other state income taxes.

- Box 19: Box 19 reports the total amount of taxes withheld from your paychecks for local, city, or other state income taxes. This amount may be deductible as part of the deduction for state and local income taxes on Schedule A.

- Box 20: Box 20 provides a brief description of the local, city or other state tax being paid. The description may identify a particular city, or it may identify a state tax such as State Disability Insurance (SDI) payments.

Tulane University Direct Deposit Policy: All employees are required to authorize electronic direct deposit of their pay.

How do I initiate or change a direct deposit? You can access your direct deposit bank information in Employee Self-Service, which you can access through Gibson Online .

For more detailed instructions, please click here

Pay stub details may also be viewed through employee self-service, which you can access through Gibson Online .

Note: To ensure the security of your information, you must be on the Tulane Network.

Duo two-factor authentication has made your accounts more secure. This safeguard prevents an unauthorized user from accessing or changing sensitive data stored in HR.

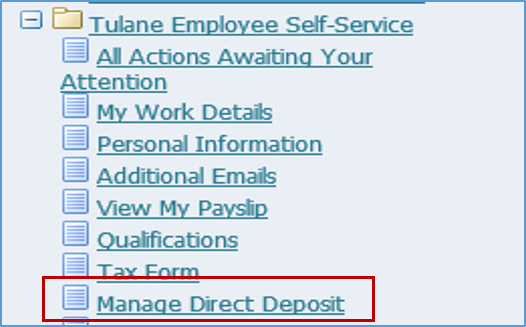

Currently, the ability to manage your direct deposit is found under Tulane Employee Self-Service and Tulane Employee Self Service—Direct Deposit Only. The Tulane Employee Self-Service—Direct Deposit Only responsibility for managing changes to your direct deposit will transition back to Tulane Employee Self-Service (screen shot below). For the next month, both responsibilities will be accessible in both places. On March 30, 2018, the Tulane Employee Self-Service—Direct Deposit Only responsibility will be deactivated.

The process for making changes, adding, or removing direct deposit details will not change, only the location of the responsibility.

Click here for more information about the options available in Employee Self-Service.

If you have questions, please contact us at hr@tulane.edu or 504-865-4748.

Tax Forms

- How do I update my W-4 form for federal income tax withholding?

- Employees update their W-4 withholding information through employee self-service. If no W-4 information is submitted to Payroll, employees will be taxed at the highest rate—single status with zero withholding allowances.

- NOTE: Foreign nationals are advised to delay completion of the W-4 as they may need to submit additional visa/immigration information to determine eligibility for completing the W-4.

- Employees update their W-4 withholding information through employee self-service. If no W-4 information is submitted to Payroll, employees will be taxed at the highest rate—single status with zero withholding allowances.

- I am a foreign national. How are my tax withholdings determined?

- The Office of International Tax will contact you to complete the necessary paperwork.

Paychecks

- Where do I receive my check?

- All employees are required to enroll in direct deposit. Paper paycheck are not issued

- What are my benefit deductions?

- Benefit deductions, including, but not limited to, health insurance, medical or dependent care flexible spending, life insurance, and retirement deductions, are handled by the Benefits team at tubenefits@tulane.edu. You can also view your benefit deductions through employee self-service by selecting Tulane Employee Self-Service > Benefits.

Direct Deposit

- How can I enroll in direct deposit?

- You can enroll in direct deposit through employee self-service by selecting Tulane Employee Self-Service > Direct Deposit. Enter your 9-digit bank routing number, account number, and account type (checking or savings).

- Can direct deposits be set up with any financial institution?

- A direct deposit can be set up with any U.S. financial institution.

- How can I make changes to my direct deposit allocations?

- Changes and additions to your direct deposit may also be made through employee self-service. If there are only changes to the amounts or percentages of existing accounts, the changes can be made without requiring the reactivation of the existing bank account.

- Where do I access my pay statements (stubs)?

- Pay statements are accessible through employee self-service by selecting Tulane Employee Self-Service > View my pay stub.

Miscellaneous

- Where can I view the Payroll calendars?

- For calendars and other important dates, click here.

- Why are the W-2s not available at the end of December?

- The IRS requires all employers to provide W-2 statements by January 31st of the following calendar year. Employees who do not consent to receiving the W-2 electronically will have their W-2 statements postmarked by January 31. For employees who provide consent to receive their W-2 statements electronically, W-2 statements will be available earlier than the mailed W-2 statement.