Tulane University offers three medical plan options through Blue Cross Blue Shield:

- 2026 High Deductible Health Plan (HDHP)

- 2026 Health Reimbursement Account Plan (HRA)

- 2026 Point of Service Plan (POS)

This page provides additional resources, tools, and guidance to help you manage your medical coverage. For plan details, see the Medical & Prescription Drug Benefits page.

New Employees: Benefits-eligible new hires are automatically enrolled in the HRA plan. You have 30 days from your hire/eligibility date to switch plans, decline coverage, or remain in HRA.

You are eligible to enroll in medical benefits if the below applies:

- An employee scheduled in HCM to work 18.75 hours or more per week

- A full-time employee scheduled to work with the university for no less than 7 months

- A part-time employee working at least 50% of a full-time schedule and expected to work no less than 7 months

These requirements apply to faculty, staff, administrators, librarians, post-doctoral fellows, and expatriates. Visit our enrollment webpage for detailed instructions on how to enroll.

Use the My Health Toolkit App to view claims, find providers, access your ID card, and more. See this flyer to get started.

Find in-network providers easily using BCBS’s search tool.

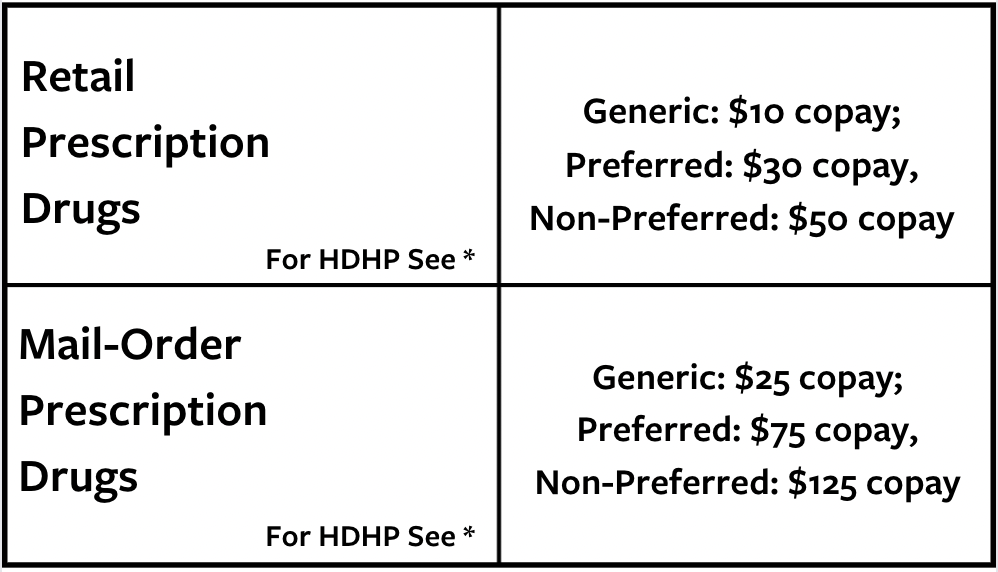

All three medical plans include the same prescription drug benefits, administered by OptumRx Pharmacy. Medical and prescription copays, deductibles, and coinsurance all apply toward your out-of-pocket maximum.

Your copay/coinsurance depends on the drug’s tier. If you have questions about your pharmacy benefits or need to locate a nearby participating pharmacy, please call the OptumRx Member Services Department at 855-896-9779, 24 hours a day, seven days a week. You may also print a temporary member ID card at Optum Rx. Follow the link for "new registration" if you have not created an account.

*HDHP: No copays. You pay the full cost until the deductible is met, then 20% coinsurance.

To explore health insurance options through the Health Insurance Marketplace, click here.

All benefits-eligible employees must have medical coverage. If you have other coverage and choose to decline Tulane coverage, complete a Medical Waiver Form and provide proof of coverage within 30 calendar days, or you’ll be automatically enrolled in HRA single coverage.

Steps to Decline Medical Coverage

- Log in to Gibson Online

- Access HCM Self-Service

- Under “Staff” or “Faculty,” click “HCM Self-Service.”

- Navigate to Benefits

- Select “Tulane Employee Self-Service” → “Benefits.” Accept the Legal Disclaimer and click “Next.”

- Review/Update Dependents & Beneficiaries

- Update if needed, then click “Next.”

- Decline Coverage

- Go to “Benefits Enrollment” → “Update Benefits,” select decline options for each plan, and click “Next.”

- Designate Beneficiaries (if applicable)

- Review & Confirm

- Review selections, print/save your confirmation, then click “Finish.”

- Sign Out of HCM and Gibson Online.

Submit Required Documents

- Complete the Medical Waiver Form.

- Provide proof of other coverage (e.g., front and back of current medical ID cards).

- Email both to TUBenefits@tulane.edu.

You’ll receive a confirmation email once processed.

Tulane Pharmacy specializes in medications for complex conditions, assists with prior authorizations and reimbursements, and can mail prescriptions directly to your home.

For hours and locations, visit: tulanepharmacy.com/#locations

Note: Cards typically mail 7–14 business days after enrollment. You only receive new cards if you are new to, or changed, plans. Otherwise, continue using your existing cards. Download the preview image here.

Insurance Card Previews:

Delta Dental:

EyeMed:

Health Equity: