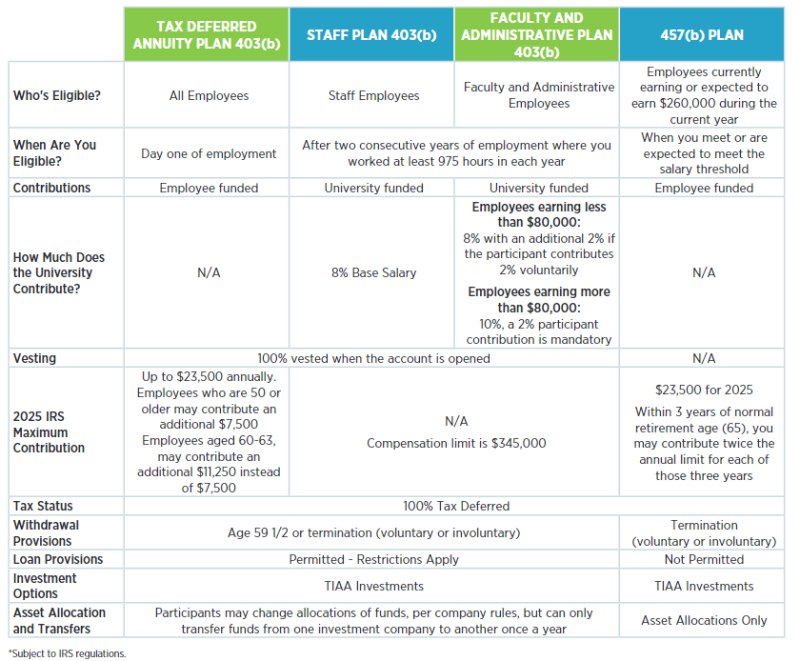

Tulane currently offers four retirement plan options, each designed to support our Tulane community, no matter where you are in your career.

Public schools and certain 501(c) tax-exempt organizations, including Tulane, offer three 403(b) plans, commonly known as tax-sheltered annuities. These plans provide a tax-advantaged way for employees to make elective deferrals from their paycheck into retirement savings. To compare the available 403(b) plans and determine your eligibility, explore the options below.

- In addition, Tulane offers a 457(b) plan for eligible employees.

For more details on how to get started, click here to view our Tulane Retirement Overview PDF.

Retirement Capabilities & Accessing Your TIAA Account

The TIAA microsite is your central hub for accessing your retirement account, managing contributions, exploring investment options, and connecting with TIAA advisors for personalized guidance. Key features include:

- Online Enrollment and Salary Deferral: Enroll in retirement plans or adjust your contribution amount. Log in to your TIAA account using your Tulane user ID and password. Once logged in, select Manage Contributions under the Actions menu. To explore investment options or schedule a call with a financial advisor, visit the TIAA microsite. Access the TIAA Guide here.

- Maximize Your Contribution: Elect to contribute the maximum amount allowed under annual IRS limits. Your contributions will automatically stop when the IRS maximum is reached and resume at the start of the following year. To set this up, log in to your account, select Manage Contributions under the Actions menu.

- Self-Directed Auto-Increment: Automatically increase your contributions to grow your savings over time. Log in to your account, select Change Your Contributions under the Actions menu, and customize the increase rate (%), start and stop dates, and timing of adjustments.

Tulane’s retirement package includes four plan types, with options available to all employees and additional plans for staff and faculty with 2+ years of service.

Below, you’ll find a summary of the four retirement plans, including eligibility details.

Click image to download.

For more information on each plan, review the details below to choose the option that best meets your future financial goals. If you have questions, please contact the Human Resources Benefits Office at tubenefits@tulane.edu.

One-on-one consultations with TIAA are available year-round to support you with your retirement planning. These private sessions can be conducted in person or over the phone at your convenience.

Appointments are offered on a first-come, first-served basis, so we encourage you to reserve your spot today:

Representative: Louis Bundy

- Phone: 1-866-843-5640

- Schedule Consultation Link

TIAA Customer Service:

- Phone: 1-800-842-2776

- Website: https://www.tiaa.org/public/support/contact-tiaa

Additional Information

In order to request a withdrawal from your Tulane retirement plans, you must meet one of the following criteria:

- You are at least age 59 ½ when you request the withdrawal.

- You have been voluntarily or non-voluntarily terminated from the university.

For 457(b) plan withdrawals, no in-service withdrawals are permitted. Therefore, you must be completely terminated, either voluntary or non-voluntary, from the university. The age 59 ½ criteria does not apply to 457(b) plan withdrawals.

If you meet one of the above requirements, you may request a withdrawal by following the steps below.

TIAA Plan Withdrawals

- Call 1-800-842-2776 to request forms.

- Sign all forms. If you are married, your spouse's signature must be notarized, or a plan administrator at the Office of Human Resources can witness the signing of papers. To have a plan administrator witness the signature, you must make an appointment in advance by emailing Benefits at tubenefits@tulane.edu.

- You will then return the forms to TIAA, or human resources can send them for you.

- The vendor will then contact us, and we will approve the withdrawal via an online portal.

Hardship Withdrawals

Hardship withdrawals are limited to the Tax-Deferral 403(b) plan with specific IRS regulations. For more information on Hardship Withdrawals, contact the Office of Human Resources at (504) 865-4748 or hr@tulane.edu.

The Tax-Deferral Plan is a 403(b) employee-funded retirement plan. All employees may enroll in this plan from day one of employment. You make contributions and have them taken out of your paycheck.

The Staff Retirement Plan is a 403(b) university-funded retirement plan. Staff employees are eligible to enroll in this plan after 2 years of consecutive service, having worked at least 975 hours in each year. After you become eligible and take the steps to enroll, Tulane will contribute 8% of your base salary.

The Faculty and Administrative Plan is a 403(b) university-funded retirement plan. Faculty and administrative employees are eligible to enroll in this plan after 2 years of consecutive service, having worked at least 975 hours in each year. After you become eligible and take the steps to enroll, Tulane will contribute up to 10% of your base salary. The percentage depends on your annual base salary.

The 457(b) plan is an employee-funded retirement plan. All employees currently earning or expected to earn $260,000 during the current year are eligible to participate in this plan. You make contributions and have them taken out of your paycheck.